Table of Content

The cost for annuities can be complex to calculate, and it's typically best to depart the math up to professionals. But if you need a rough estimate of what your monthly payments will be, you can use the PMT operate in Excel. If you are looking for a step-by-step information on the means to calculate annuity funds in Excel, you've come to the right place.

Assets will proceed to be invested well into all three phases, no matter whether the annuity is fastened, indexed, or variable. By following annuity rules, earnings will accumulate on a tax-deferred foundation till withdrawals are ready to be made. An indexed annuity, generally known as an equity-indexed annuity, combines features of each fastened and variable annuities, although they are defined as a hard and fast annuity by authorized statute. They pay out a guaranteed minimal such as a set annuity does, however a portion of it is also tied to the efficiency of the investments inside, which has similarities to a variable annuity.

Decide The Principal Steadiness

Because the funds are invested in assets that fluctuate in worth, it's attainable for the entire worth of property in a variable annuity to be lower than the principal. Investors who cannot tackle this threat are most likely better off with a fixed annuity. Keep in mind that variable annuities have a few of the highest charges in the financial trade. After getting acquainted with the annuity payout choices, let's reveal how you can apply the annuity payout calculator by way of an example and see the way to calculate annuity payments.

However, several annuity calculators are available on-line that can be utilized as a reference. Moreover, their primary focus is on providing personalised quotes tailored to your needs. Firstly, determine the PV of the annuity and ensure that the payment will be made at the end of every period. Brian Colvert is a Certified Financial Planner and the CEO of Bonfire Financial.

What Is Annuity Payment?

There are a number of options for selecting how annuity payouts happen, and never all annuities offer every payout choice. The Annuity Payout Calculator only calculates mounted cost or fastened length, two of the most typical options. In non-qualified annuities (annuities that are not used to fund tax-advantaged retirement plans), a portion of every cost is taken into account both earnings or principal. The latter might be tax-free, whereas the former is topic to the same taxes as strange income.

ExcelDemy is a spot the place you'll be able to be taught Excel, and get solutions to your Excel & Excel VBA-related issues, Data Analysis with Excel, and so forth. We present tips, tips on how to guide, provide online training, and also present Excel solutions to your corporation issues. You can use the NPER perform to calculate the Annuity Period of Annuity Payments in Excel. You can use the RATE operate to calculate the Interest Rate of Annuity Payments in Excel. Here, C5 denotes the financial value which you're going to get yearly. You can use the FV operate to calculate the Annuity Payments in Excel.

Get 5 Free Video Lessons With Uncommon Insights To Speed Up Your Financial Progress

The construction of a Deferred Income Annuity is much like that of an SPIA. As against a direct annuity, you receive annuity funds over time. Your annuity might come with a assured minimum rate of interest, that means your interest rate won't ever fall under that degree. To discover your interest rate, you can name the supplier or examine your account on-line to see whether it is variable.

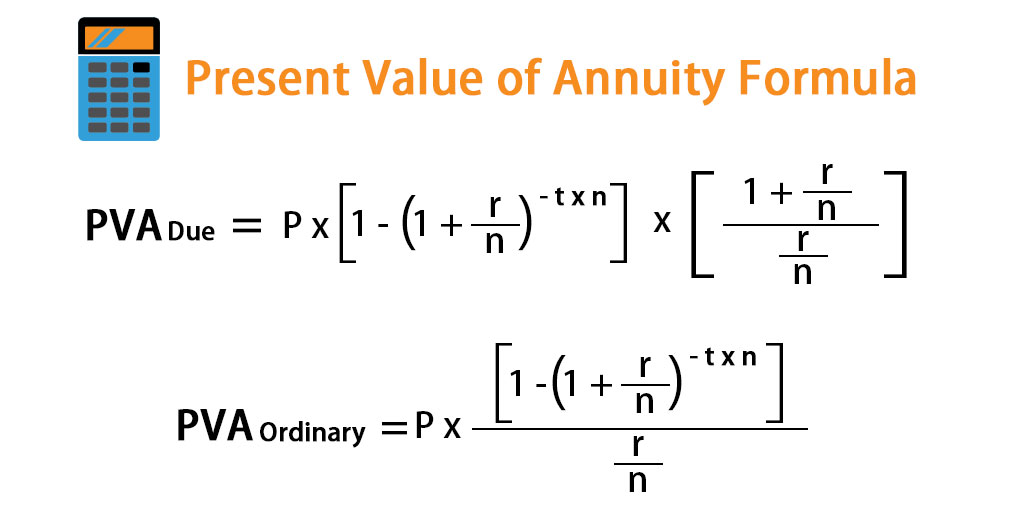

Estimates provided aren't binding and topic to further considerations, including taxes, that will result in a higher or decrease payout. Please contact a Schwab consultant for more information.See extra important disclosures. Use this calculator to search out the present value of annuities due, strange common annuities, rising annuities and perpetuities.

So, let's assume that you just invest $1,000 every year for the following five years, at 5% interest. Below is how much you'd have at the end of the five-year period. Alternatively referred to as a longevity annuity, a QLAC is a type of special annuity. In a QLAC, you fund the annuity together with your certified retirement financial savings, corresponding to those from an IRA or 401.

Real estate investors also use the Present Value of Annuity Calculator when shopping for and selling mortgages. This reveals the investor whether the value he is paying is above or below expected value. The Present Value of Annuity Calculator applies a time worth of cash formula used for measuring the current worth of a stream of equal payments on the finish of future durations.

In odd annuities, funds are made on the finish of every period. With annuities due, they're made firstly of the interval. Recurring payments, such because the hire on an apartment or curiosity on a bond, are sometimes referred to as "annuities." David Kindness is a Certified Public Accountant and an expert within the fields of economic accounting, corporate and individual tax planning and preparation, and investing and retirement planning.

A lump sum is more commonly chosen by investors near or already in retirement to be able to begin the annuitization and payout section as quickly as possible. This allows them to start receiving distributions which might be normally guaranteed for all times immediately. Also called "quick annuities" because their distribution, or payout, of income is almost quick, they have very quick accumulation phases consequently. On the other hand, a sequence of payments could be extra helpful for youthful traders who need to develop wealth over time in order to have future income in retirement. As an apart, even after the accumulation part of an annuity ends, it doesn't cease growing in worth .

However, the eventual distributions during a future tax year are subject to ordinary income taxes. A low cost rate immediately affects the value of an annuity and how a lot cash you obtain from a buying firm. The present worth of an annuity is the present cash value of all future payments, impacted by the annuity’s price of return or low cost price. It’s essential to recollect the time value of cash when calculating the current worth of an annuity as a result of it incorporates inflation. The lower an annuity’s rate of return is, the higher the annuity’s current value shall be. When t approaches infinity, t → ∞, the variety of payments method infinity and we now have a perpetual annuity with an higher restrict for the present value.

In general, commissions for variable annuities common around 4% to 7%, while immediate annuities average from 1% to 3%. Fixed annuities pay out a assured quantity after a certain date, and a return price is largely dependent on market interest rates at the time the annuity contract is signed. In theory, excessive rate of interest environments permit for larger price mounted annuities . However, the worth of present, already issued fixed-rate annuities isn't impacted by changes in interest rates. Most do not have cost-of-living changes , and as a result, their actual purchasing power could decline with time.

Steady Compounding (m → ∞)

Here, I even have used the PMT operate which calculates the cost based mostly on an Annuity with a continuing interest rate and regular funding. Wendy Swanson, Retirement Income Certified Professional™, explains the method to estimate how a lot monthly earnings you may obtain from an annuity over time. Annuity suppliers base revenue benefits on an annuitant’s life expectancy, which they decide using your age and gender. The variety of years your investment will generate payments at your specified return. The investment info offered on this table is for informational and common educational purposes solely and shouldn't be construed as investment or financial advice.

No comments:

Post a Comment